The government’s growth strategy seems to be one that will kickstart a virtual cycle while guarding against fiscal slippage, because of international war situations. The budget has many promises making good noises, but one only hopes that the final July budget will be different

Shivaji Sarkar

Shivaji Sarkar

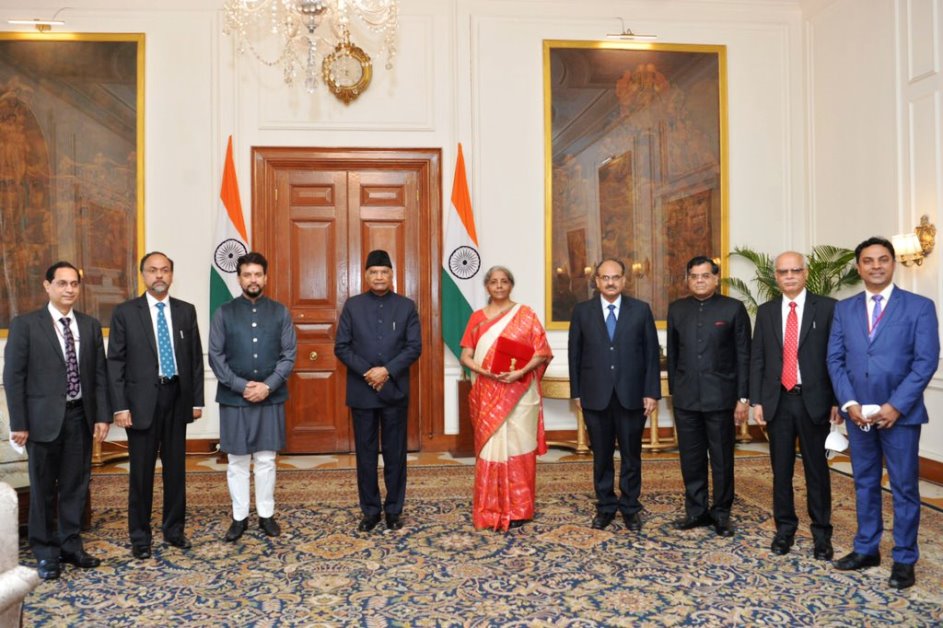

It is a sparkling poll budget right from the President’s address of Draupadi Murmu harping on the economy, to Finance Minister Nirmala Sitharaman harping on the need to give hope to the people, attract investments, highest capital expenditure, focus on rural recovery with housing, post-harvest activities unveiling series of programmes for farmers, women, middle class and dream GDP growth of 7.3 per cent.

The election emphasis was sharper in the President’s speech as she unfolded the narrative of space to the economy and the finance minister announced bringing a White Paper on mismanagement of the economy till 2014, which marks an era of one of the five fragile economies led by Congress-led UPA. It may also illustrate how it is becoming one of the top five economies.

The President in her ceremonial address to the joint session of Parliament in the new building presented the government’s achievements over 10 years across a variety of areas, offering a glimpse into the issues the BJP-led NDA might focus on ahead of the 2024 elections. “Since childhood, we have been hearing the slogan of “Garibi Hatao” (Indira Gandhi’s plank in 1971), now for the first time in our lives, we are witnessing eradication of poverty on a massive scale” adding that the poor people, youth, women, and farmers would be the four ‘strong pillars’ of Viksit Bharat.

Repeating the “four pillars”, Sitharaman stressed the various programmes on the path to progress and growth. She repeatedly harped on all kinds of farming classes – farmers, fishermen, dairy developers, the potential voters.

The interim budget is not without its focus to impress. It has large figures such as Rs 47.65 lakh crore expenditure (about Rs 3 lakh crore more than 2023-4), Rs 30.8 lakh crore revenue including Rs 26.06 lakh crore from taxes, capital expenditure outlay rise by 11.1 per cent to Rs 11,11,111 crore, 3.4 per cent of GDP, a 50-year-interest free innovation loan and foreign direct investment of $596 billion – twice the inflow during 2005-2014, the UPA period, inflow.

But a matter of concern is its fiscal deficit and maturity of dated securities, long-term bonds that are to mature and have to be repaid. Though technically fiscal deficit comes down to 5.1 per cent from last year’s 5.8 per cent, she said gross and net borrowings through dated securities would be Rs 14.25 and 11.75 lakh crore. Total debt, external and internal, at Rs 168.72 lakh crore on 31 March 2024 is set to rise to 183.67 lakh crore. Outstanding debt has increased by Rs 15 lakh crore entailing the higher interest liabilities.

One interesting factor is the technicality in economic terms, and she is right. Debt is earning and boosts GDP. The Finance Ministry so far has never reneged on its repayment commitments. The debt burden seems higher than revenue earnings.

The finance minister has cut Rs 32000 crore subsidies in for food, fertiliser, and petroleum. The food subsidy cut comes amid the rising minimum support prices. It banks on the reduction of the number of beneficiaries following Adhar linkages. The allocation to MNREGA, however, is raised to Rs 86000 crore from Rs 60000 crore in the current fiscal.

Outgo to States as their share of revenue is Rs 22.22 lakh crore. Interest payment liability has been budgeted at Rs 11.90 lakh crore, 10.18 per cent more than 2023-24. The innovation funding as interest-free loans for 50 years may be reviewed. The timeframe is too long though and may give a psychological edge.

Sitharaman has not announced any concession on the tax front. The highest income tax rates remain at 39 per cent while corporate tax remains at 22 per cent and a new venture at 15 per cent. Her core supporters are critical as she ignored the “middle class” facing high cumulative inflation of 27.5 per cent in five years at the rate of Reserve Bank’s India’s 5.5 per cent a year. One comment is interesting. It says, “We are clearly, not a vote bank that needs to be appeased”.

Expectedly her focus is on climate, farmers, agriculture growth and other measures that would immensely improve the conditions of the people as per the principle of ‘Reform, Perform and Transform’ and goes on to include MSMEs, aspirational districts, the Eastern region, and its people – Bihar and West Bengal, key electoral targets! Other than the PM housing for rural areas, for the first time she mentioned housing for the middle class “living in rented houses, or slums, chawls and unauthorised colonies” to buy or build their own houses.

Along with are mentioned agriculture and food processing to employ 10 lakh persons, post-harvest activities including aggregation, modern storage, supply chains and marketing, intense dairy development, setting up of fisheries department to boost Matsya Sampada, five aquatic parks and seafood exports. Also announced was the Atmanirbhar Oilseeds Abhiyan. The premise is that these sectors would transform critical sectors and please the crucial electorate in the farm sector in various parts of the country. However, the difference between farmgate prices and high retail for consumers has yet to be bridged.

Women have been wooed in different ways. A laudable scheme of course is vaccination for girls in the age group of 9 to 14 for the prevention of cervical cancer. Similarly, maternal and child health care is being brought under one comprehensive programme. Anganvadis are upgraded as centres for nutrition delivery, early childhood care and development. Ayushman Bharat benefits are being extended to all Asha, Anganvadi and helpers. It is expected to incentivise the grassroots workers.

Overall health has got Rs 1095 crore more at Rs 90,170 crore and education Rs 13000 crore at Rs 1.25 lakh crore. The budget also affects cuts in Rs 32000 crore subsidies in food, fertiliser, and petroleum.

The government is adhering to the fiscal glide path, retaining the capex focus offering as much as trillion rupees in 50-year interest-free loans to private players to take up scientific research. The finance minister is buoyant on consumer confidence and has subtle satisfaction with inflation being in the 2 to 6 per cent range even though the RBI has been insisting on a 4 per cent target for stabilising the economy.

The government’s growth strategy seems to be one that will kickstart a virtual cycle while guarding against fiscal slippage, because of international war situations. The budget has many promises making good noises, but one only hopes that the final July budget will be different.—INFA

Advertisements | 5E For Success

5 Advantages of KRC 5E for Success MDP course, powered by KRC Foundation.

1. Employability training

2. Internship

3. Earn while you learn ( Work Experience Certificate, subject to selection and performance)

4. 100% Cashback on Fees through Global Garner

5. KRC Membership & Placement Assistance.

Send your resume to get a free profiling session and selection.

Email resume: 5eforsuccess@gmail.com

WP: 9531090090